Alternative Performance Measures (APMs) are "a set of ratios and numerical measures of past, present or future performance related to financial position, earnings or cash flows", the publication of which has been required by the European Securities and Markets Authority (ESMA) since 2015 for listed companies. The purpose of their publication is to facilitate the comparison and understanding of the financial performance of companies by the various market players, and they include ratios common to all companies and measures designed to illustrate the business performance of a given sector, such as "RevPAR" in the hotel sector, or the "Minimum Requirement for Own Funds and Eligible Liabilities" in financial institutions.

One of the main "MARs" is EBITDA, known as Earnings Before Interest, Taxes, Depreciation and Amortization, also known as gross operating profit plus depreciation and impairment, and is one of the concepts most analyzed by risk departments when authorizing current financing for a company.

This indicator analyzes the capacity of an organization or company to generate profits, taking into account its productive activity. This value is calculated before deducting financial expenses.

How is it calculated?

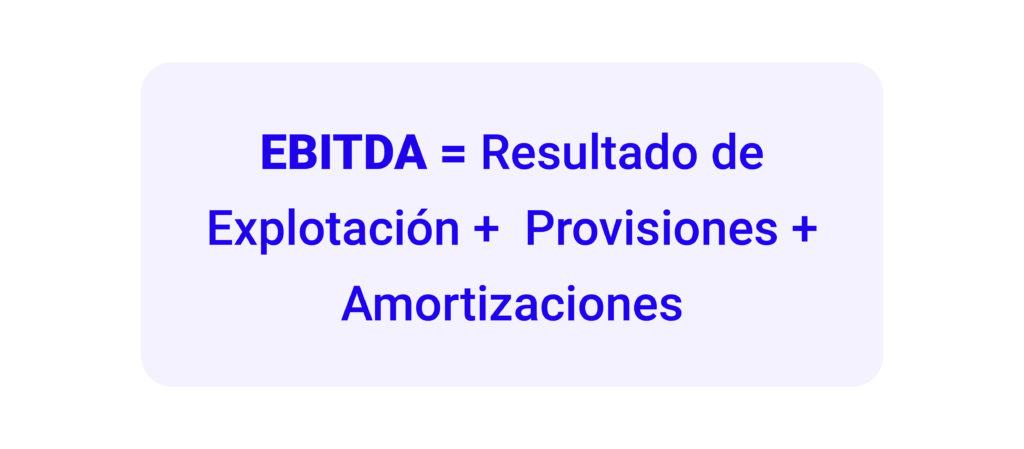

To find this value, we must add depreciation (provisions) and amortization to the operating income (revenues - fixed costs - administrative and selling expenses).

The value is a result that does not take into account certain circumstances, since each company has a specific configuration of income and expenses depending on its type of business. Therefore, it does not measure the liquidity of the company (as cash flow), but it is an internal indicator of the company's profitability.

Advantages

It facilitates the comparison of the results obtained by the different companies since it does not take into account the financial leverage between companies or the different tax, depreciation and amortization rates.

This value can be positive or negative:

- Positive EBITDA: reflects profitability, i.e. it shows that the project is favorable, but it cannot be taken as an absolute value since it also depends on taxation and how the company is financed.

- Negative EBITDA: reflects that a certain project will not generate profits.

Obviously, it is always better to be positive, but there is no optimum value, as this will depend on the economic sector to which the company belongs, the project, as well as the level of leverage.

It should be noted that the condition that all revenues and expenses included in EBITDA must meet is that they pertain to operating activities. In other words, they must constitute the main source of the entity's ordinary income -excluding consumption of fixed capital- and must be recurring over time in order to be included as an item.