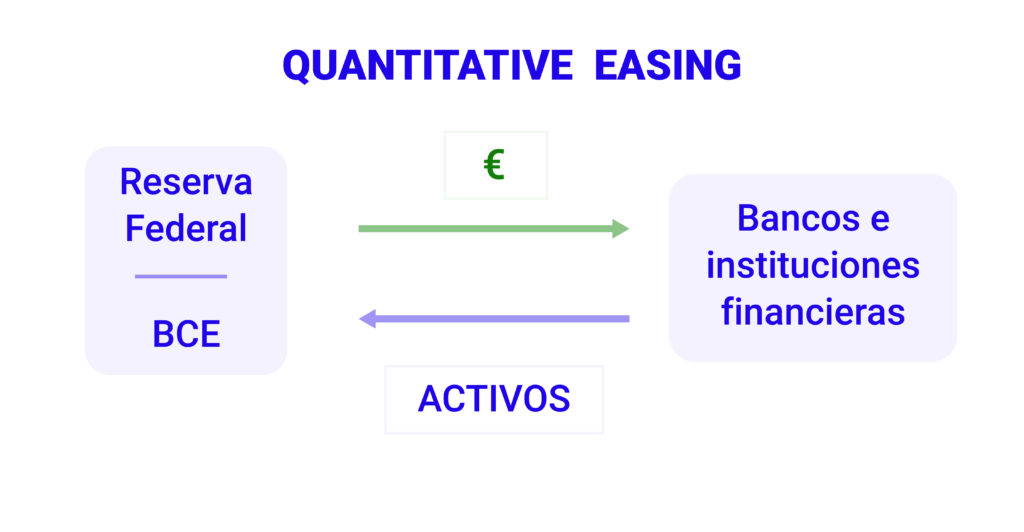

This is a monetary policy through which central banks can buy financial assets and government or corporate bonds, thus seeking to contain interest rates and increase the money supply in the market, in order to boost consumption and employment. Therefore, when conventional measures do not have the expected results and interest rates cannot be lowered any further, quantitative easing is used.

Quantitative easing is a concept that was first used by German economist Richard Werner in the 1990s. It was based on the idea that the central bank did not have to buy so much government debt but rather aggressively acquire the long-term assets of private banks.

At the end of 2008 at a time when a global recession was approaching after the outbreak of the financial crisis, the US Federal Reserve began its quantitative easing program, buying as much financial assets as possible around the world. As a result, it managed to inject some US$ 3.7 trillion into the US economy, which was dispersed throughout the world economy over the next five years.

Another moment of application of this policy occurred on the occasion of the Covid-19 pandemic, which paralyzed economic activity in a large part of the world. The major central banks coordinated joint action in the face of the possible recession. On Sunday, March 15, 2020, the Federal Reserve, in coordination with the reserves of the EU, Switzerland, the United Kingdom, Japan and Canada, announced QE with lower interest rates, asset purchases, and the reduction of swap lines.

One of the criticisms of this monetary policy is the idea that unproductive investment is ultimately deflationary in nature. Considering that providing liquidity to private banks is ineffective because they use it in the financial markets and do not use it to expand credit to the population, it is therefore a failed maneuver.

It is important to know how the market reacts to quantitative easing, since there is an instantaneous spike when the news is known and an eventual adjustment of the price after the application of the measure, causing a loss of value in the currency, since in short, more currency in circulation is added to the market.